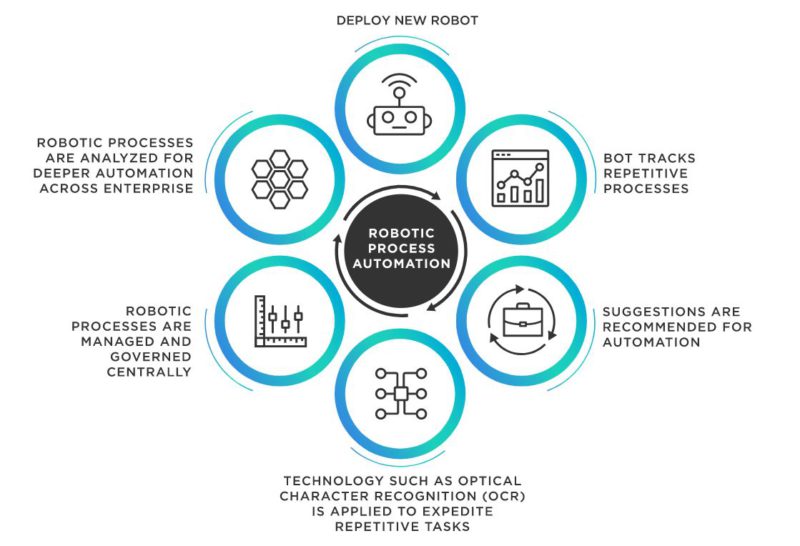

Some of the most popular applications are using chatbots to respond to simple and common inquiries or automatically extract information from digital documents. Choosing the right type of tasks to automate is critical to success. Financial institutions should make well-informed decisions when deploying RPA because it is not a complete solution. Tasks such as reporting, data entry, processing invoices, and paying vendors. RPA helps perform redundant tasks quickly without error. The key to getting the most benefit from RPA is working to its strengths. The fast lane is enterprise software that is reusable and can be scaled.The second lane in which a template is provided and programmers design the robot.The slow lane which involves web scraping.Highly customized software streams that will work with only certain types of processes.Furthermore, some financial institutions are exploring a category of automation technology called robotic process automation (RPA) that can automate transactional tasks at scale. Research from the McKinsey Global Institute concludes that 40 percent of financial activities such as cash disbursement, revenue management, and general operations can be fully automated. While bank automation is enticing as a concept, CFOs need a clear understanding of what kind of tasks can be automated. Automation and robotics to improve processes in banking This is spurring redesigns of processes, which in turn improves customer experience and creates more efficient operations.

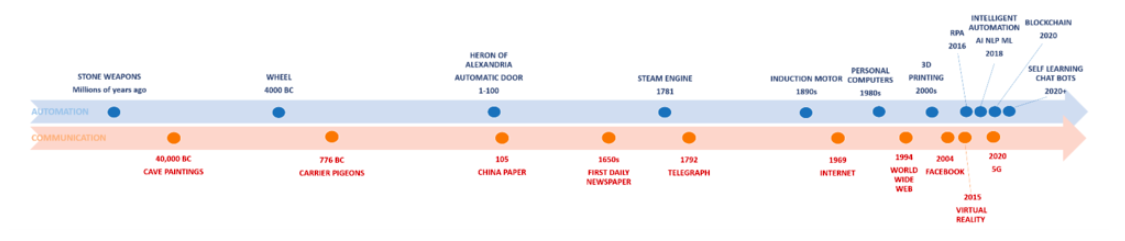

The repetitive tasks that once dominated the workforce are now being replaced with more intellectually demanding tasks. In the current Fourth Industrial Revolution, automation is improving the bottom line for companies by increasing employee productivity. Since the Industrial Revolution, automation has had a significant impact on economic productivity around the world. Now, with the advancements in AI and machine learning, what does the future hold for the banking industry? Banking Automation in terms of Productivity

With the invention of the internet and cellphone came mobile banking, further dissipating the need for tellers to do basic tasks like withdrawing money or account inquiries. Since then the ATM paved way for the banking industry to focus more on customer service and other banking needs. We first saw automation take hold with the first automatic teller machine (ATM) in 1969. Automation is nothing new in the banking industry.

0 kommentar(er)

0 kommentar(er)